what is 1601c|BIR Form 1601C : Baguio Supply values for the Amount of Compensation on items 15, 16A, 16B . SWU PHINMA’s Architecture Program aims to develop The Intelligent Design Catalyst. He/She is a facilitator of intelligent, responsive and functional design, a creator of human spaces that have deep and lasting value, and a perceptive, intuitive, analytical critical thinker with a deep understanding of humanity. The Architecture Program .

PH0 · Use BIR Form 1601

PH1 · Understanding BIR Form 1601

PH2 · Procedures in accomplishing BIR Form No. 1601C

PH3 · Generating BIR Form 1601

PH4 · Did You Know You Can File BIR Form 1601C via Taxumo?

PH5 · Did You Know You Can File BIR Form 1601C via

PH6 · BIR Form No. 1601C

PH7 · BIR Form No. 1601

PH8 · BIR Form 1601C: Purpose and Guidelines in the

PH9 · BIR Form 1601C Help Page

PH10 · BIR Form 1601C

Thesaurus.com is more than just a website for finding synonyms and antonyms of words. It is a comprehensive online resource that helps you improve your vocabulary, writing, and communication skills. Whether you need a word of the day, a synonym for a common term, or an example sentence to illustrate your point, Thesaurus.com has it all.

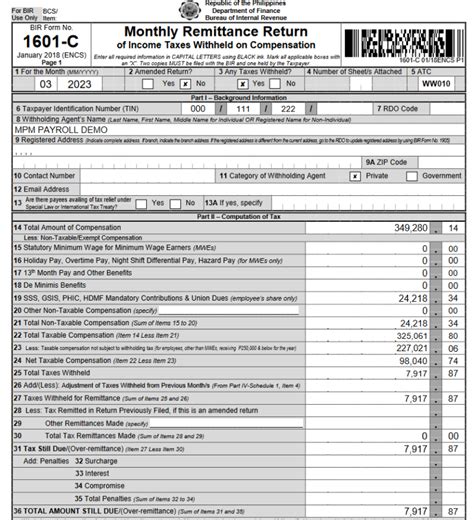

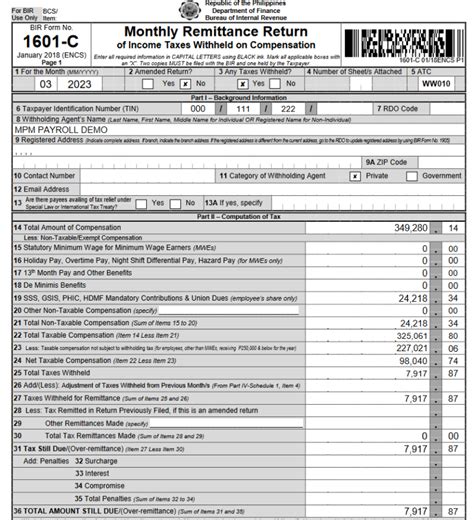

what is 1601c*******Learn how to file and pay the monthly remittance return of income taxes withheld on compensation by employers or payors in the Philippines. Find out the guidelines, instructions, penalties, and violations for this form.Monthly Remittance Returnof Income Taxes Withheldon Compensation. 1. For the .

Supply values for the Amount of Compensation on items 15, 16A, 16B .Monthly Remittance Returnof Income Taxes Withheldon Compensation. 1. For the Month (MM/YYYY) 01 - January 02 - February 03 - March 04 - April 05 - May 06 - June 07 - .

BIR Form 1601C is the monthly tax return for employers who withhold tax on compensation of their employees. Learn what is compensation, how to comput.

BIR Form No. 1601-C Monthly Remittance Return of Income Taxes Withheld on Compensation. Guidelines and Instructions. Who Shall File. This return shall be filed in .

BIR Form 1601C is a document that businesses in the Philippines need to file every month to report and pay taxes withheld from their employees' compensation. Learn who files it, when to file it, and . Supply values for the Amount of Compensation on items 15, 16A, 16B and 16C, Tax Required to be withheld item 18, Taxes Remitted Previously Filed item 21A (only .BIR Form No. 1601C Filing Help. 1. Familiarization of the form. a. Entry Fields. These colored white text fields or option buttons are used to enter data. b. Display Fields. . BIR Form 1601-C is a report that businesses file every month to show how much taxes they have withheld from their employees' pay. Learn how to use this form as a guide for payroll computation and the .

BIR Form 1601C is a monthly tax return for employers who withhold income tax from their employees' salaries. Taxumo helps you enter, compute, and file your 1601C forms online with less hassle and .

To file a BIR Form 1601-C in Fast File, follow the steps below: STEP 1: From your portal, click on the Start Return button. STEP 2: Select Income Taxes Withheld on .Adding Employees and Compensations for 1601C. This section will help you on adding compensation(s) for employees in your 1601-C form. Written by Maui Banag. Updated over a week ago. In order for you to process your 1601C form (Monthly Remittance Return of Income Taxes Withheld on Compensation), you would need: The BIR has released its new form on the remittance of monthly withholding taxes on compensation last November 2020 - the new BIR Form 1601-C (with a dash). .16B: Holiday Pay, Overtime Pay, Night Shift Differential Pay, Hazard Pay (Minimum Wage Earner)Yes, it will! Take note that each time a salary is given, you should input it as a salary expense under the Compensation tab. So it follows that if you release salaries semi-monthly, then that's two salary expenses in the Compensation tab per employee.Additionally, you should categorize each salary expense as semi-monthly!(To be filled up by the BIR) DLN: PSOC: PSIC: Fill in all applicable spaces. Mark all appropriate boxes with an “X”. 1 For the Month 2 Amended Return? 3 No. of Sheets Attached 4 Any Taxes Withheld? (MM / YYYY) Yes No Yes No The BIR Form 1601C is listed as one of the Bureau of Internal Revenue (BIR) tax returns in our blog post 4 Common Tax Deadlines MSMEs should remember. Now, let’s dive deeper into the details.Understanding the tax returns can save you from potential headaches down the road. That’s why we prepared a comprehensive guide that only .

How To Fill Up 1601 C Bir Form (employer's Guide)

ON NOVEMBER 27, 2020, the Bureau of Internal Revenue (BIR) issued Revenue Memorandum Circular (RMC) 125-2020 to inform the public on the availability of the new BIR Form 1601-C (Monthly Return of Income Taxes Withheld on Compensation) January 2018 (ENCS) in the Electronic and Payment System (eFPS).BIR Form 1601C ON NOVEMBER 27, 2020, the Bureau of Internal Revenue (BIR) issued Revenue Memorandum Circular (RMC) 125-2020 to inform the public on the availability of the new BIR Form 1601-C (Monthly Return of Income Taxes Withheld on Compensation) January 2018 (ENCS) in the Electronic and Payment System (eFPS).

First off, congratulations! You are now collecting taxes on behalf of the BIR through expanded withholding tax. Granted, you probably didn’t really have a choice but, fret not: compliance to this tax type is not as hard as you think.

What You Need To Know. A significant change had occurred in early 2018 where tax authorities had issued a Revenue Regulation (RR) No. 11-2018 which amended certain provisions of RR No. 2-98 and implemented new amendments introduced by the Tax Reform for Acceleration and Inclusion (TRAIN) Law in relation to withholding taxes.what is 1601cThe Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .what is 1601c BIR Form 1601C The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .

The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .The end of the calendar year is near and during the year-end, companies with employees will perform tax annualization to determine the final income tax due to be reported to the BIR. It is also the time where companies .This return shall be filed by every employer or withholding agent/payor who is either an individual, estate, trust, partnership, corporation, government agency and instrumentality, government owned and controlled corporation, local government unit and other juridical entity required to deduct and withhold taxes on compensation paid to employees.First BIR-Accredited Tax Platform l Tax Automation l E-Filing and Payment of Taxes

How to compute withholding tax on compensation and wages in the Philippines?If you have seen a Monthly Remittance Return of Income Taxes Withheld on Compensation or BIR Form No. 1601-C, you will only see totals of compensation and tax withheld on compensation of the taxpayer’s employees.You will not have an idea on the . Employer responsibilities. Ensuring the correct amount: It is the employer’s responsibility to ensure that the amount of compensatory tax withheld from employees’ pay during each financial year is correct and filed with the BIR every month. Submission of the BIR Form 1604-C: The employers must then submit BIR Form 1604-C at the end of each . Employers must understand the withholding tax framework that applies when processing and computing payroll in the Philippines!. That’s why, in this article, we examine BIR Form 1604-C! BIR Form 1604-C is a key annual payroll-related tax return that must be filed by employers in the Philippines to confirm the value of the tax on .

Welcome to the Official site of Department of Migrant Workers! Learn more about the Philippine government, its structure, how government works and the people behind it.FRISCO - After all of the Odell Beckham Jr. drama and posturing, a Dallas Cowboys fan likely feels twisted into a knot featuring both "anticipation'' and "skepticism.''

what is 1601c|BIR Form 1601C